It was recommended that overseas financial companies should recognize this as a major growth area and strengthen their overseas remittance, credit loans, and customized products for each nationality.

Just as South Korea has partnered with high-value companies and targeted foreign residents, the domestic financial industry should also secure its competitiveness through expanding partnerships and medium- to long-term investments.

According to the KB Financial Holdings Management Research Institute on the 6th, Kim Nam-kyung, an advanced researcher, wrote in his recently published report, “How foreign financial companies can welcome foreign customers,”

Examples of applying new technologies to improve customer experience, develop customized products and services, and strengthen financial access are helping to expand the foreign customer base and realize inclusive finance.

"This is the result of our efforts to achieve this goal," he said, suggesting that Korean financial companies should also benchmark themselves. The service most needed by foreign customers is overseas remittance. According to Statistics Korea and other sources,

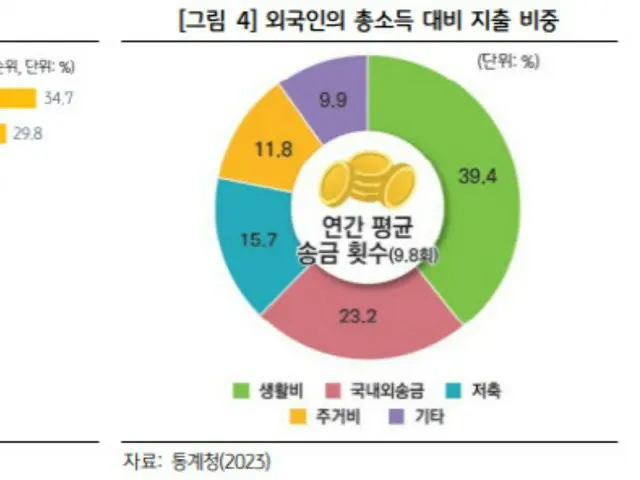

The average number of domestic and international remittances made by foreigners per year was 9.8, and for non-professional workers, domestic and international remittances accounted for 56.5% of their total income. The amount of overseas remittances per year is estimated to exceed 20 trillion won.

Global banks have been leveraging new technologies to improve their most needed remittance services. Standard Chartered Bank (SC) announced in November 2024 that it will open a new banking platform for remittances in the UK.

We have partnered with the Wise Platform, a remittance infrastructure of the technology company Wise, to launch SC Limit.

SC Limit has decided to enhance its remittance service by integrating Wise's platform API to provide an improved remittance experience.

Wise plans to offer a service that allows customers to send money in 21 major currencies in real time within seconds. In fact, approximately 63% of Wise's international remittances are already completed within 20 seconds.

The company is also said to be improving the transparency of its fee structure by applying mid-market rates without additional fees or mark-ups.

Santander has launched One Pay FX, an international remittance app that utilizes the blockchain technology of the American fintech company Ripple.

OnePay FX was released in 2018. OnePay FX is based on Ripple's distributed ledger technology "xCurrent" solution, which enables fast settlement and settlement.

The service is highly compatible with existing banking systems, making it easy for banks to implement. The service is currently being used in six countries, including the UK, Spain, and Brazil, and is being used in over 24 countries.

Some transactions are processed in real time, and many can be processed on the same day or the next day. The remittance process involves the payment of the expected amount, exchange rate, fees, etc.

Kim Nam-kyung, a research fellow at Advanced, said, "OnePay FX is superior to conventional SWIFT network transfers in terms of transaction speed and transparency.

"It has demonstrated superior performance to gold," he said, adding, "It can be considered a successful example of a blockchain-based, bank-led international remittance service."

A common problem faced by foreigners residing in the country is that they are often denied credit despite having the ability to repay.

The lack of a transaction history means that even basic credit cannot be provided. Global banks are increasingly looking to expand creditworthiness in their home countries to meet the needs of emerging customers such as foreign workers and immigrants.

They are taking strategies such as partnerships and mergers and acquisitions (M&A) to share records. Kim, a research fellow at Advanced Research, said, "The global bank HSBC is trying to acquire Nova Credit, a cross-border personal credit rating agency.

"We have partnered with Nova Credit to help foreigners with no credit history in the UK access financial products using their home country's credit information (through an API linkage method)," he said.

"HSBC UK has partnered with NovaCredit to launch international credit record sharing services and mortgage products," the company said.

HSBC receives real-time international credit records through NovaCredit's Credit Passport.

The company will take credit records from 12 countries and integrate them into its credit scoring system to assist with data processing and credit scoring, allowing foreign customers in the UK to access credit records from 12 countries when applying for credit cards.

Kim, an advanced research committee member, said, "Credit card use leads to building a local credit history, which in the long run improves access to better financial products." He added, "Housing loan approval is

"This will provide substantial assistance to immigrants seeking housing stability," he said. Global bank Citi is also expanding its U.S. operations after acquiring Mexican bank Banamex.

It offered binational financial services such as savings accounts and credit cards to Mexican immigrants in the United States. It now provides services that simultaneously cover customers in both the United States and Mexico.

Although the company does not provide financial services, its binational financial services at the time were praised for increasing financial access for immigrants through measures such as exempting remittance fees, relaxing ID requirements, and issuing cards.

Korean financial companies also need to develop the "blue ocean" market by strengthening their competitiveness in overseas remittances, resolving the credit gap problem for foreigners, and developing customized products for each country.

Kim Advanced, a research fellow, said, "In the international remittance market, technological capabilities and network expansion are key competitive factors," adding, "Korean financial companies are also focusing on remittance speed, cost burden, and transparency of procedures."

"We should expand strategic partnerships with fintech blockchain remittance networks and overseas payment networks to improve customer experience in this area."

If a foreigner does not have a domestic credit history, we will cooperate with overseas credit rating agencies so that their credit history in their home country can be reflected in their credit rating.

Another option is to offer customized accounts and preferential fees that reflect the financial needs and characteristics of customers of specific nationalities or cultural backgrounds.

Kim Advanced, a research committee member, said, "Domestic financial companies will also partner with fintech companies, overseas banks, and global payment networks that have market competitiveness.

"We will be able to expand and develop a variety of services, including overseas insurance, investment products, and tuition payment," he said, adding, "We will help foreigners settle in Japan, from the initial period of arrival to stabilizing their lives, building assets, and long-term residence."

"We should also start considering ways to provide remittance, loan, investment and insurance packages at each stage," he suggested.

2025/09/08 16:46 KST

Copyrights(C) Edaily wowkorea.jp 88