However, investors are still optimistic, believing that the stock price is still on the upward trend in the medium to long term.

According to a Korean economic analysis platform on the 18th (today), HYBE was trading at 268,000 won (approximately 26,800 yen), down slightly by 0.92% from the previous trading day.

HYBE hit a high of 323,000 won (approximately 32,300 yen) during trading hours on the 2nd of this month, plummeting 17% for the first time in about two weeks.

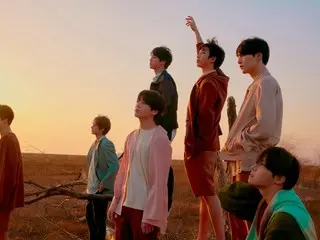

Meanwhile, HYBE is working on the return of BTS, a group under the label BIGHIT Music, to the group's full-form group, which has raised expectations.

The company had been updating its stock price, but has recently been hesitant due to negative news about "owner risk" following the indictment of Chairman Bang Si Hyuk by prosecutors.

Earlier, the Securities and Futures Commission under the Financial Services Commission announced the first

The company held four regular meetings and announced that it had filed charges and reports against Chairman Bang and other former executives of HYBE to the prosecution. Chairman Bang said that he had sought compensation from existing shareholders to prevent HYBE from being listed during the process.

The existing shareholders are suspected of believing Chairman Bang's words and selling their shares to a special purpose corporation (SPC) established by a private equity fund in which HYBE executives were involved.

It was revealed that Chairman Bang had concealed the fact that he had signed a shareholder agreement with the private equity fund, which included a provision to receive 30% of the profits from the sale.

In particular, President Lee Jae-myung recently announced that he would strongly punish those who "withdraw" from illegal trading activities.

However, there is talk in the market that Chairman Bang may become the “first” to take over the company. However, the securities industry believes that a takeover strategy would be effective if the stock price were to be adjusted due to negative factors related to owner risk.

With BIGHIT's new boy group about to debut, is there any prospect that the performance will improve as the central artist "BTS" will start full-scale activities from next year?

With expectations of mid- to long-term momentum, stock market investors are raising their target prices in droves, even as second-quarter earnings are expected to be sluggish.

According to the report, HYBE's second quarter operating profit was 73.5 billion won (approximately 7.35 billion yen), which is a much lower figure than last month's 30th (88.4 billion won).

DS Investment Securities has raised its target price from the current 330,000 won (approx. 33,000 yen) to 370,000 won (approx. 37,000 yen). Also, DS Investment Securities has raised its target price from the current 300,000 won (approx. 30,000 yen) to 370,000 won (approx. 37,000 yen).

The target price was raised by 10% to 30,000 won. Mirae Asset Securities has set a target price for HYBE of up to 390,000 won (approximately 39,000 yen).

DS Investment Securities researcher Chang said, "BTS will release a new album and hold a world tour in the spring of 2026.

"They will then begin activities as a full group, and as we anticipate BTS starting full-scale activities, we are revising our 2026 forecasts upwards."

2025/07/18 20:28 KST

Copyrights(C) Edaily wowkorea.jp 111